Well, let’s admit it. At some point in our HR Career, we have all wondered: should we include DA mandatorily in the structure, should we keep the Basic Pay at 30%-40%, or Should CTC include Gratuity? Certainly, I did, especially as I come from an Engineering background with no formal education in HR. The beauty of lack of HR knowledge was that I had to find each of these stuff from scratch for which the web and my fellow HR colleagues from and around Kochi helped. Special thanks to the connections I received through NIPM (one of my imminent blogs is on why HRs should network; catch you there soon!).

In this article, I intend to give a primer—a very basic understanding—of how we can structure the salary in India. I would speak of the structure as of 2021, to the best of my understanding, belief and practice.

Wait, tell me about the parlance!

Before we begin, let’s make sure that we get the terms right. During my tenure as an engineer, I never cared about the terms such as Gross Pay and what mattered was the CTC and Cash in Hand. But as an HR professional, there’s more to it and I believe all folks across all departments should get an idea about the payroll parlance. Here’s the gist:

- Cost-to-Company (CTC): This is an accounting term with no legal definition whatsoever. You cannot find this term in any of our labour acts. You use it for your convenience, or for accounting purposes. No one else cares (except probably the job applicants).

- Employee/Employer Contributions: There are some mandatory contributions that employee and employer have to make periodically. While employee contributes Employee EPF, Employee ESI, TDS, Professional Tax, Employee Labour Welfare Fund contributions, etc., the employer also needs to make contributions such as Employer EPF, Employer ESI, Employer Labour Welfare Fund contributions. Employee contributions are deducted from the Gross Pay, while Employer contributions are outside the Gross Pay. More on those terms below. Please note that EPF and ESI are mandatory only if your organisation falls into the respective requirements.

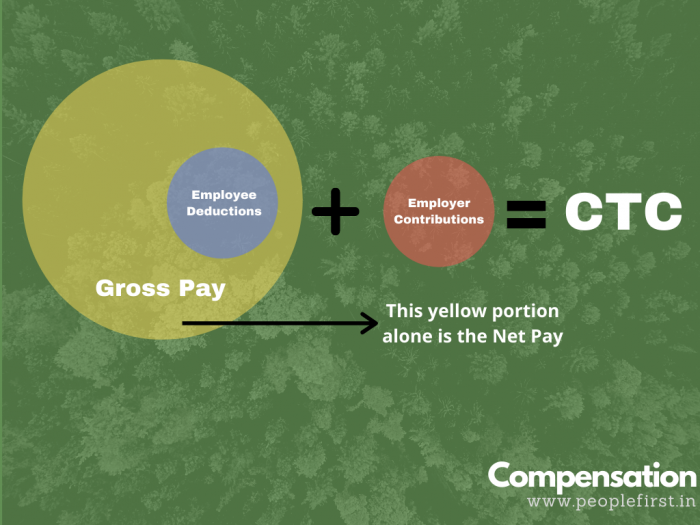

- Gross Pay: Before I define Gross Pay, we must understand that the CTC is the sum of all payroll expenses an employer incurs on an employee. Basically, CTC includes the salary and other expenses the employer incurs (more on that later). Now, let’s split the CTC as (What Employee Deserves + Extra Expense for the Employer). Here, the “what employee deserves” component is the Gross Pay. Look at the Venn chart above.

- Net Pay: An employee has to pay statutory (or even non-statutory) contributions such as EPF, ESI, TDS, etc. These contributions of the employee are deducted from the Gross Pay. In effect, the Net Pay = Gross Pay — Employee Contributions.

Well, we got it covered; pretty much!

What all are in the CTC?

Elementary, my dear Watson! CTC = Gross Pay + Employer Contributions.

Oh wait, I got your question. You’re basically asking, what all can be there in the ‘Employer Contribution’, correct? Well, the answer is ANYTHING. You can include the mandatory employer contributions as detailed above, plus some other stuff. Some companies include valuation of ESOP in the CTC, some include the amount that the company pays for insurances for the employee/family, etc. As a standard measure, let’s keep the statutory contributions such as ER EPF, ER ESI, ER LWF and the like in the CTC. The best practice, in my opinion, would be NOT to include benefits and other rewards in the CTC with the purpose of inflating it to look attractive. Variables are welcome to be included in the CTC, but we need to mention that they are variables.

How do I structure the Employee Salary?

We’ve finally come to the million dollar question. How do we compartmentalise the salary? I am trying to explain this in the form of a FAQ compilation below:

What are basically the components of Gross Pay?

Broadly, let’s say, Gross Pay contains the Basic Pay, DA, HRA, and other allowances.

Why have you mentioned HRA separately, even when it is an allowance?

HRA has some exemptions with respect to definitions of wages (e.g: EPF calculation where HRA is exempted from consideration).

Okay, understood. Now, tell me whether that DA is mandatory?

As long as you are paying above the minimum wages (read my other article on Minimum Wages to understand how DA is calculated), you can subsume DA in the Gross Pay, without having to show it separately. There are certain occasions (e.g: in the case of those who are using the Wage Protection System in Kerala) some organisations are forced to show DA separately, which I would have no objections against.

How about Basic Pay? Is it 30% or 40%?

Basic Pay used to be defined as any percentage of the Gross Pay by organisations at their will. But as per the proposed Code on Wages, 2019, to be effective from Apr 1, 2021, the (Basic Pay+DA) component should be at least 50% of the Gross Pay (legal nerds, please do not raise your eyebrows; I have used the term ‘should’ as in suggestive parlance and in a practical sense). Assuming that you are not showing DA component in the salary structure, let’s then fix Basic Pay as 50% of the Gross Pay.

Remember, if you are following 30% or 40% of Gross Pay as Basic Pay, you are recommended to revise the same to 50% wef Apr 1, 2021. This will, also, have impact on your financials such as Earned Leave Encashment, Gratuity, etc.

Aha, I see. So Basic is Fixed. How about HRA?

HRA is NOT a mandatory allowance. But it is a general practice to provide HRA for the employees to meet their accommodation expenses. Further, HRA is exempt from income tax, while Basic Pay, DA and allowances such as Special Allowance are fully taxable. HRA has an income tax exemption rule, which is three-tiered, details of which I am omitting for now. For metro cities, a maximum of 50% of Basic Pay can be non-taxable, while in non-metro cities, it is 40%. I would then suggest that we go with HRA = 40% of Basic Pay if you are in Kerala.

We’re getting close. Now tell me about ‘Other Allowances’?

Code on Wages mentions about Retaining Allowance, which is an allowance provided to the employee for the retention purposes (this should be part of the offer letter if you are providing it, and you should call it ‘Retaining Allowance’ itself). Generally, new-age companies, usually do not include this in their structure and provide the rest of the salary as “Special Allowance”.

So, in short and in a crude form:

Gross Pay = Basic Pay + HRA + Special (Other) Allowance.

Can you explain it as a salary structure?

Well, that’s my job to explain. Here it goes:

| Component | Amount |

| A. Basic Pay | 50% of Gross Pay |

| B. HRA | 40% of Basic Pay |

| C. Special Allowance | Remaining amount to reach the Gross Pay |

| D. Gross Pay | Sum of (A), (B) and (C) |

| E. Employee Deductions | TDS, EE EPF, EE ESI, PT, EE LWF, etc. |

| F. Net Pay | (D) — (E) |

| G. Employer Contributions | ER EPF, ER ESI, EDLI, ER LWF, etc. |

| H. CTC | Sum of (D) and (G) |

Wait, where is the Conveyance Allowance?

Conveyance allowance is a thing of the past. HRs usually included it in the salary structure since that component, up to an extent, along with Medical Reimbursement used to provide some tax benefits to the employee. Not any longer. It stopped two years ago when the concept of standard deduction was introduced in the union budget and there is no point of mentioning Conveyance Allowance in the pay structure unless you want to have one more column for your Finance team to manage.

(But wait, the Conveyance Allowance may sound well for salary structures when Code on Wages comes into force on Apr 1, 2021. That’s a different subject to talk about; but for starters, look at the exemptions from the definition of ‘wages’)

No, it can’t be this simple. I do not see any other allowance—such as LTA, Books and Periodicals, etc. Where are they?

Now we are on the right track! Well, these allowances are non-mandatory allowances, but at times provide great relief for the employees from a portion of their income tax. Such allowances are in fact reimbursements against actual bills, though some of them are paid in advance under the expectation that the employee would submit the bills to the employer by the end of the financial year.

Now to answer the question, yes there can be some such allowances as part of the salary structure. But they are simply the babies of the ‘Special Allowance’. Special Allowance (even this one is not a mandatory allowance; we use it as a filler bucket to make sure that the components add up to Gross Pay) is fully taxable. One can split the Special Allowance into smaller allowances/reimbursements so that a part of it becomes supposedly non-taxable. That’s a story for another discussion, which you can see in my next blog—Flexi Benefits as part of Salary Structure.

Okay, but you didn’t tell us about the statutory calculations yet.

Fine. Here’s the snapshot. Tables speak better.

| Component | Per Month Contribution | Observation |

| EE EPF | 12% of (Basic Pay+DA+Other allowances excluding HRA) | Go with 12% (Basic + DA + Special Allowance)*Some orgs have been exempted and some have 10% contributing rate |

| ER EPF | 12% of (Basic Pay+DA+Other allowances excluding HRA) | Go with 12% (Basic + DA + Special Allowance)* |

| EE ESI | 0.75% of ESI Wages | ESI wages include all components including Basic Pay, HRA, Special allowance, OT, etc., but excludes components like Annual bonus, Retrenchment compensation, and Encashment of leave and gratuity |

| ER ESI | 3.25% of ESI Wages | Same as above – |

| PT | Depends on your state and salary range. This will help you | |

| EE LWF | Rs. 20/- for S&CE LWF in Kerala. Differs based on the nature of establishment | |

| ER LWF | Rs. 20/- for S&CE LWF in Kerala. Differs based on the nature of establishment | |

| TDS | On the Employee’s Earnings. Depends on the existing Income Tax rates | |

| EDLI and admin charges | Details here | One may or may not include this as part of Employer Contributions |

* Assumption: No other ordinarily paid allowances (other than those like OT, Performance-based incentive, etc).

So far so good. But I have read that there is a cap for EPF contributions. What is that and how is it incorporated in the salary structure?

Yes, EPF up to 12% of Rs. 15,000/-, i.e. up to Rs. 1800/- per month by Employee and Employer each is mandatory. If the (Basic + DA + Other allowances except OT, Bonus, HRA, etc.) is less than 15,000/- per month, then the EPF contribution will be less than Rs. 1800/-, which is fine. Suppose the above amount is Rs. 25,000/-. Then the 12% of 25,000 = Rs. 3000/-. The employee is not liable to pay this entire amount to EPF and can decide to cap it as Rs. 1800/-. This would mean that the employee’s EPF deduction will be Rs. 1800/- instead of Rs. 3000/-, meaning the net salary might increase since the deduction is lesser.

Another catch here is, the employer is liable to pay the equal contribution as the employee makes. So if the employee decides to cap it at Rs. 1800/-, the employer can also do the same, which may be a loss to the employee in the long term as a hole on the savings. But modern-day organisations tend to transfer the benefit of this capping to the employee, by fixing the CTC and increasing the Gross Pay to match the difference, still, all of them totalling to CTC. This would mean that the employee might get a higher net salary even if s/he caps the EPF contribution, but the transfer of benefit depends on the employer and is at their will.

Popular Posts on this Website

The post is getting longer by the minute. Would you like to conclude?

So, in short, our intention is to add up the component to Gross Pay and then add employer contributions to reach the CTC. When an offer is made (or a salary revision is recommended), companies usually look at the total cost that it would incur. The rest is on HR to design the structure in the most favorable manner.

More fun on the way

The calculation to sum up earnings, employer contributions, etc. to reach the CTC is pretty straightforward with simple arithmetic calculations. But it can become slightly complex when you are given a CTC and asked to bifurcate it to various components especially when there is a cyclic dependency is involved (e.g: ESI contribution depends on the components of the salary structure, while those components depend on the ESI contribution).

This is not rocket science and can be solved with a system of first-degree multi-variable equations. As long as we have HRMS in place, this won’t be a headache, but don’t you think it would be fun to go back to high school math and see how that helps in the above HR situations? Post your responses in the comment below and let’s see who gets it right first! Let me blog on the math later.