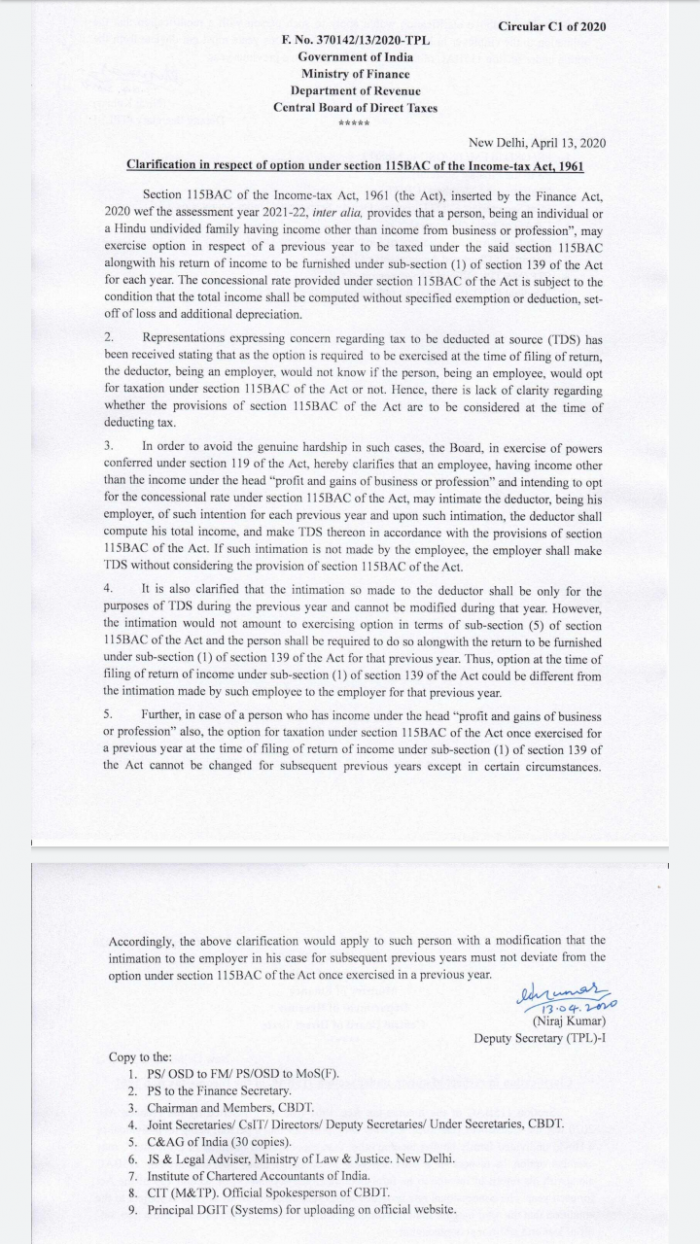

Update (Apr 13, 2020): Govt of India has clarified that the employee can ask deductor (employer) to consider new tax regime for taxation (provided certain conditions of no-business income, etc. are met). The notification below is just in. Thanks to Ankit Lohiya for updating me about the notification.

Hence, the article below stands void.

In the 2020-21 budget by the Govt of India, a new tax regime was announced. The below table depicts the difference between the old regime and the new regime. HOWEVER, Govt has announced that it will give an option for the citizens to choose which tax regime they would like to be taxed on.

Source: https://timesofindia.indiatimes.com/

Does that mean I can tell my employer to tax me on which regime?

As it looks, your employer cannot take such an option from you to choose which income tax regime they should tax you on.

So, what will the employer do?

The employer will still need to, as of today, continue deducting income taxes per the old regime (like how they used to do during FY 2019-20). They cannot ask, or take a choice from, the employee on which regime to tax on, nor they can tax them other than on the old tax regime.

When can I then choose my tax regime?

The employee can choose the tax regime at the time of his/her Income Tax returns. The IT department will recalculate the income tax and ask you to pay/refund an additional amount.

Why is it that so? Why can’t employers take option from employees?

As per the Finance Act, 2020 which is enacted by the Parliament, taxes are to be withheld and paid to the Government as per Part I of First Schedule of the Act (please see screenshots below).

The Government has, in fact, introduced the new tax regime not by altering the Part I of First Schedule above, but instead by introducing the new regime as a new section (Section 115BAC). As long as Part I of First Schedule is changed/amended with the rates mentioned in 115BAC, the employer needs to follow the old regime for TDS.

Can I change choose old regime in the years to come, if I choose the new regime during FY 2020-21 (AY 2021-22) during income tax returns?

No, 115BAC mandates that in case of individuals and HUFs who have income either from a business or a profession, once this option is exercised, they will have to continue with the new regime for that year and all subsequent years.

(with inputs from multiple resources and people, including Sreelal).