April 2021 is around the corner and there are a lot of buzz about the four new labour laws which are going to be in effect from Apr 1, 2021. One of them is Code on Wages and that’s effectively a revised version of Payment of Wages Act 1936, Minimum Wages Act 1948, Payment of Bonus Act 1965 and Equal Remuneration Act, 1976.

One of the major questions that HRs are facing these days is how the definitions are changing and how it’s going to affect the salary structures. It is their Y2K problem. Employees—who are not in the HR community—are worried as to how this is going to impact their take home salary, as depicted by some of the news outlets in the country.

Before we begin

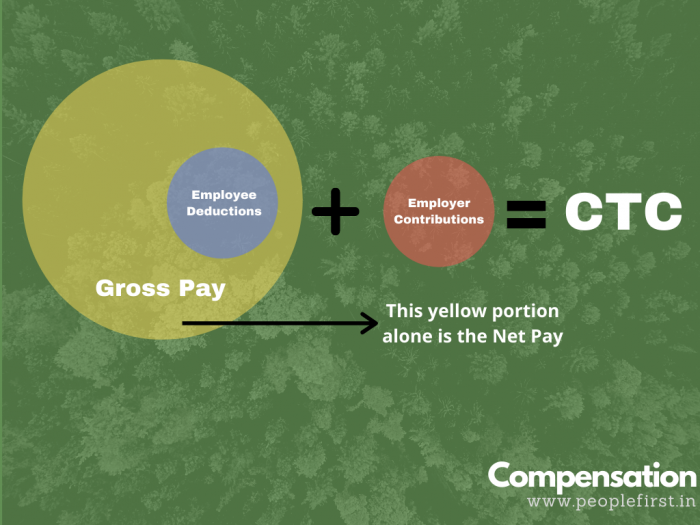

Please make sure that you read my previous article on how salary structuring works (keep in mind that it was pre-Apr 2021). That article will help you understand various jargons in the Comp and Ben sector and make sure that you get the difference, inter alia, between Gross Pay, CTC, Employer Contributions, Employee Deductions, etc. Let’s call that article a prerequisite for this one.

Introduction

Code on Wages, along with the other three new labour laws, comes into effect from Apr 1, 2021; however, rules for all the four are not yet finalised and notified, but we hope that would happen soon so that they are in effect from the aforementioned date.

This article discusses some major impact these acts bring in to the Compensation and Benefits regime. I will focus more on the payroll structuring per se, rather than other major changes therein. Let’s dive in:

Definition of Wages

Definition of wages seemed to be one of the complicated definitions in the labour realm in India for many years. EPF Act defined wages differently than the ESI Act, and every other act in the country had its own definitions of Wages. With the new set of four consolidated labour laws in place, this confusion is removed. All the laws now provide a single definition of wages, as given below:

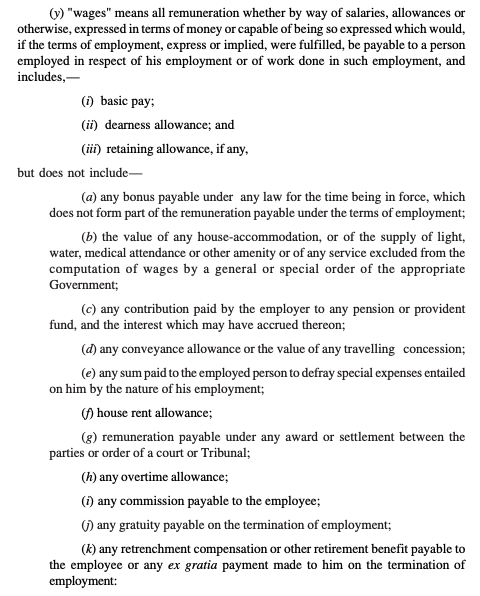

As per the Code on Wages:

“wages” means all remuneration whether by way of salaries, allowances or otherwise, expressed in terms of money or capable of being so expressed which would, if the terms of employment, express or implied, were fulfilled, be payable to a person employed in respect of his employment or of work done in such employment, and includes,—

- basic pay

- dearness allowance and

- retaining allowance

Further, the Code excludes the following components from the definition of wages: bonus payments;

- any bonus payable under any law for the time being in force, which does not form part of the remuneration payable under the terms of employment;

- the value of any house-accommodation, or of the supply of light, water, medical attendance or other amenity or of any service excluded from the computation of wages by a general or special order of the appropriate Government;

- any contribution paid by the employer to any pension or provident fund, and the interest which may have accrued thereon;

- any conveyance allowance or the value of any travelling concession;

- any sum paid to the employed person to defray special expenses entailed on him by the nature of his employment;

- house rent allowance;

- remuneration payable under any award or settlement between the parties or order of a court or Tribunal;

- any overtime allowance;

- any commission payable to the employee;

- any gratuity payable on the termination of employment;

- any retrenchment compensation or other retirement benefit payable to the employee or any ex gratia payment made to him on the termination of employment

Additional Clauses on Calculation of Wages

The goes on to state the following, which forms the crucial part while structuring salaries:

Provided that, for calculating the wages under this clause, if payments made by the employer to the employee under clauses (A) to (I) exceeds one-half, or such other per cent as may be notified by the Central Government, of the all remuneration calculated under this clause, the amount which exceeds such one-half, or the per cent so notified, shall be deemed as remuneration and shall be accordingly added in wages under this clause.

Provided further that for the purpose of equal wages to all genders and for the purpose of payment of wages, the emoluments specified in clauses (d), (f), (g) and (h) shall be taken for computation of wage.

Explanation.––Where an employee is given in lieu of the whole or part of the wages payable to him, any remuneration in kind by his employer, the value of such remuneration in kind which does not exceed fifteen per cent. of the total wages payable to him, shall be deemed to form part of the wages of such employee.

Reading the Clauses in the Act in Detail

- It is evident that the Basic Pay is part of Wages.

- DA, if it is part of the pay structure, it is included in Wages.

- Retaining Allowance is also part of the Wages. It is to note that Retaining Allowance ≠ Special Allowance. You need to specifically provide this component and with the specific purposes thereof to make it Retaining Allowance, in the Offer Letter/Appointment Letters.

- Gratuity, Statutory Bonus, HRA, ER EPF, ER ESI, OT, Commissions, and retrenchment compensation are excluded in the calculation of Wages.

- Payment in kind such as payment for house accommodation (some companies provide free house accommodation for their employees for the initial few days or for a longer term) shall be excluded from Wages

- Payment for special purposes shall be excluded from Wages

- Dispute Settlements are excluded from Wages

- Conveyance allowance is excluded from Wages.

- The exclusion components should not be more than 50% (of the gross pay). If it is more than 50%, then the 50% of the gross pay shall be deemed to be the Wages.

Can the Inclusion Components (Wages) be more than 50%?

Yes. The act only says that the exclusion components should not be more than 50%. That clearly means that the inclusion components should be at least 50%. This also means that the Wages should be at least 50% of the gross pay. It can very well be above the 50% limit; and it can also be 100% of the salary. Provide the entire Gross Pay as Basic Pay, and no one will question you (though this is not ideal for both the employee and the employer).

Should Basic Pay be 50% of Gross Pay (or 50% of CTC)?

There are some articles that say the Basic Pay should be 50% of the CTC, which is wrong. The act only says that the exclusion components should not be more than 50% (= inclusion components should be at least 50%). That does NOT mean that the Basic pay should be 50% of Gross Pay.

Further, no acts in India talks about the CTC. It’s a term that our companies and accounting officers coined. When an act refers to the word salary, it, generally, means the gross pay.

Are all allowances excluded from Wages?

Just because a component has the word ‘allowance’ it is not excluded as such. You may want to revise how the definition of Wages begins: “wages” means all remuneration whether by way of salaries, allowances or otherwise. It essentially says that the word ‘allowance’ simply does not exclude it from Wages.

Is Special Allowance Excluded from Wages?

This is a hot and debated topic over the last few months. Indian companies use Special Allowance as a bucket to fill in to reach the CTC. That is, when the CTC is split into different components such as Basic Pay, HRA, etc. the remaining amount goes to Special Allowance so that they all add up to CTC. As long as your offer letter and/or the appointment letter does not have any specific definition (vide Exclusion List# E) related to Special Allowance, it is INCLUDED in the Wages. Here’s a presentation from Deloitte if you would like to have a look.

If you disagree with the above reading, please let me know in the comments and why.

Is HRA excluded from Wages?

Yes, HRA is excluded from the Wages Calculation.

Is Variable Pay included in Wages?

Performance-based variable pay will be an inclusion component in Wages, since that does not appear on the exclusion list.

So, what’s the big deal now?

The big deal is to make sure that your salary components are in line with the Code and that the Wages components is at least 50% of the Gross Pay. If your components are already in line with this math, you do not have to worry about restructuring at all. Peace!

Wait, can you tell me what all components can be there in a Salary Structure?

It would be unwise for an outsider to comment on how your components should be. However, below are some ordinarily paid salary structure components that one may find in the IT industry. I am trying to give you a comparison of those components with respect to the act.

| Component | Included in Wages? | Taxable |

| Basic Pay | Yes | Yes |

| Dearness Allowance | Yes | Yes |

| HRA | No | Yes/No, subject to limits |

| Special Allowance | Yes | Yes |

| Conveyance Allowance | Yes | Yes |

| Telephone & Internet Expenses | No | Yes/No, subject to limits |

| Books & Periodical Expenses | No | Yes/No, subject to limits |

| Fuel and Vehicle Maintenance | No | Yes/No, subject to limits |

| Annual Gift Coupons | No | Yes/No, subject to limits |

| Monthly Food Coupons | No | Yes/No, subject to limits |

| Medical Allowance | No | Yes |

| Uniform Allowance | No | Yes/No, subject to limits |

| School Fee Allowance | No | Yes/No, subject to limits |

My recommendation would be to choose the excluded components that may be relevant to job families and job roles in your organisation. If you have certain such components to defray special expenses already in your organisation, you won’t have to remove them and may not have to make much changes. The catch is that these components will help reduce your Wages (yet keeping at the minimum requirements) and help employees save some income tax (flexi benefits—more on that later).

Hey, what if the Wage goes high? Is there a Problem?

Well, as I mentioned before, the definition of Wages is now standardised. All the acts say that the benchmark on which retiral benefits and other such employee benefits are calculated will be based on Wages. Hence, from a financial point of view, it would be a good idea to look at where you need to keep the balance.

Some companies still continue to pay EPF on the Basic Pay (which may still be over and above the statutory limit of 1800). Such calculations of EPF, ESI, etc. will now be on the Wages component. Some companies may take a hit unless they restructure the salaries since a hike in Wages may imply a hike in employer contributions as well. Likewise, the Gratuity is currently based on Basic Pay, which may change from Apr 1, 2021, subject to final terms in the rules yet to be finalised. Similar is the case with Statutory Bonus as well, whose details are still not finalised. You may read the act for more information on these provisions; I am skipping the details since it may derail the purpose of this act.

Can you give me a sample salary structure?

Yes, I will. Let’s consider the IT industry in Kerala for example.

| Component | Included in Wages? | Calculation | Amount (INR, Monthly) |

| Basic Pay (BP) | Yes | 41.67% of Gross Pay | 15,000 |

| HRA | No | 40% of B. Pay | 6,000 |

| Conveyance Allowance | No | 2,000 | |

| Books & Periodical | No | 2,500 | |

| Fuel & Vehicle Maintenance | No | 2,400 | |

| Internet & Telephone | No | 2,500 | |

| Monthly Food Coupons | No | 2,500 | |

| Special Allowance (SA) | Yes | 3,100 | |

| Gross Pay | 36,000 | ||

| Employer EPF | No | 12%*(BP+SA) | 2,172 |

| Employer ESI | No | 3.25%*(BP+SA) | 588 |

| Employer LWF | No | 20 | |

| CTC | 38,780 | ||

| CTC (Annual) | 4,65,360 |

In the above example, the Included Components (=Wages) sum as: 15,000 + 3100 = 18,100/- which is 50.3% of the Gross Pay.

Hey, you talked about Flexi Benefits. What’s it?

Flexi benefits is a way for providing income tax exemption benefits for your employees. There are certain salary components that the Government of India allows employees to save taxes on. The idea is to allow, at the start of the financial year, employees to choose these benefits if they want them. Employer may then exclude those components from TDS and at the end of the financial year, the employees shall submit the proofs to the employer who may then re-calculate the taxes based on the quantum of proofs. Some such components are:

- HRA: HRA up to 40% of the Basic pay in non-metro cities and 50% of basic pay in metro-cities is exempt from income tax (subject to certain other conditions therein)

- Food Coupons: Differs for industry and days of work, but in general Rs. 2500/- per month is exempted when provided as food coupons/food cards (not as cash).

- Annual Gift Coupons: A sum up to Rs. 5000/- per year if provided as a gift coupon is exempted from income tax.

- Telephone and Internet: The cost of internet and telephone, against bill submissions, are exempted from income tax. You may keep a logical limit as Rs. 2500/- per month for the same.

- Books & Periodical: same as Telephone and Internet.

- Fuel and Vehicle Maintenance: Rs. 1800 to Rs. 2400/- per month depending on the CC of the engine, and only available for Cars. Usually provided to senior leaders or those who may undertake travels on behalf the company.

It may also be noted that if the company otherwise reimburses any of the above components, the same shall not be duplicated as a salary component.

In the interest of controlling the Wages, you may want to revisit if you should be offering all of these flexi benefit components at your organisation. If some employees do not opt for these, their Special Allowance may increase and hence the Wages. Have a look and decide for yourself!

Can we restrict the EPF to Rs. 1800/- per month?

Rs. 1800/-, which is the 12% of the statutory limit of Rs. 15,000/- per month is the mandatory (upper cap) payment to EPF. Any amount above this is voluntary. If the organisation decides to cap the EPF at Rs. 1800/- per month, they are at their will to do so. But if the organisation has provided a higher figure in the offer letter/appointment letter, they will not be able to take a one-sided decision of reducing this component. Maybe, you want to revisit your offer letter/appointment letter templates for future issues 🙂

Can’t HRA be more than 40% of Basic Pay?

HRA can. 40% of Basic Pay is the limit for income tax exemptions. Don’t confuse yourself between income taxability and definition of Wages.

How’s it going to affect my take home salary?

If your organisation has included Gratuity as a component in the CTC, then if the Gratuity component goes up and CTC remains the same, it will effectively reduce your take home salary. Similarly, if the CTC is fixed and the employer redesigns the salary structure in such a way that the EPF/ESI component goes up, that will also affect your take home salary. It all depends on how your current salary structure is defined and how it is going to be in Apr 2021. Non-HR readers: you may want to consult your HR team soon!

Disclaimer

This article is written in my personal capacity and advisory in nature. The figures or components mentioned herein have no relationship with my employer or employer’s decisions. Neither my employer nor does my professional role endorses the content in this article. I shall not be liable to any action that you conduct or pursue upon the reading provided by me above.